Saving money is something that too often we learn to do too late. How many of us have had to go into debt to learn this lesson? How many are still learning? The sad truth is that not much importance gets placed on learning to save. But this simple skill can change lives. That’s why it’s essential that we start teaching our children good habits before they make financial mistakes that can set them back economically when they are older. Since financial responsibility is not a priority in school curriculums it’s up to us to demonstrate when teaching kids to save money, why it is important. Here is how you can do that in 5 easy steps.

1. The Concept of Money

When teaching kids to save money you have to start with the basics of what money is and how you use it. We explain things to our kids all the time and that’s how they learn. However, the concept of buying and selling often goes unexplained. The other day I watched a children’s show that takes place within a shop. Throughout the show, customers came and went with no money changing hands even after a supposed purchase. Your children may not even think twice when you swipe a card at the grocery store or use Tap to Pay. If you don’t call it out, they’ll never understand that a transaction is taking place.

2. Money Play

Money play is a great way to put the concept of money transactions into action. Playsets that incorporate a cash register are great. So are games that use cash, like Monopoly. Incorporate cash transactions into various imaginative play. Coffee shop, restaurant, grocery store, hardware store, etc. As many as you can think of to teach the concept of spending money. Teach them subtraction and addition as part of play so they learn how to add up tickets and subtract from their purse. Avoid playing with credit cards. Teach about using cash on hand.

3. Helping Mom/Dad with Work

The next thing to help kids understand is where the money comes from. Teach your kids about what you do to earn money. Even tell them how many hours of work you put in to afford a purchase. Let them help you with your work – even if it’s only pretending. Let them be involved in what it is like to earn money. If you don’t have a home office, you can explain your job and what you do for money in a way that they will understand. Plant the idea that they should think about what they want to do to make money when they are older.

4. Price Checking

The next thing to do when teaching kids to save money is to get them familiar with how much things cost. check prices on everything together when you go shopping. Go through weekly circulars together. Give them an understanding of how much things cost, especially things that are relevant or important to them, like toys and treats.

5. The Concept of Saving

With all of these building blocks in place, your kids will be primed to understand why saving money is so important. Talk about saving up for something big like a trip or an important home project. Talk about the importance of an emergency fund. Talk about saving for college, and for retirement. Answer all their questions about why you save for different things and why borrowing money is never a good idea. Teaching kids to save is as simple as demonstrating how money works and teaching them that borrowing money on credit is not the answer to future success.

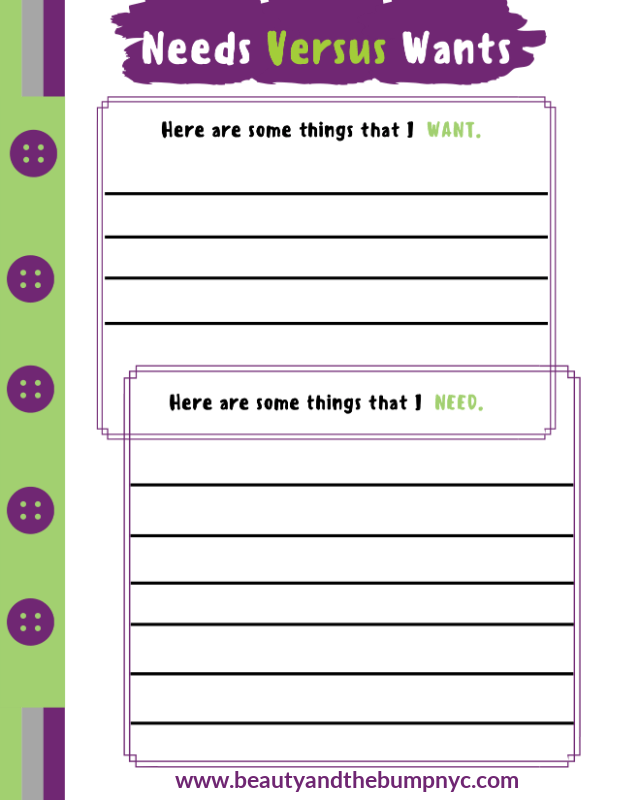

Download this FREE six-page Kids Money Savings Planner printable to help your kids set goals and learn the importance of saving money.